As the economy worsens and businesses face increased pressure from bad debts, we focus on helping businesses nip them in the bud. Here, we set out 3 WAYS in which debt recovery claims are optimized.

1. Summary Judgment (SJ) Procedure

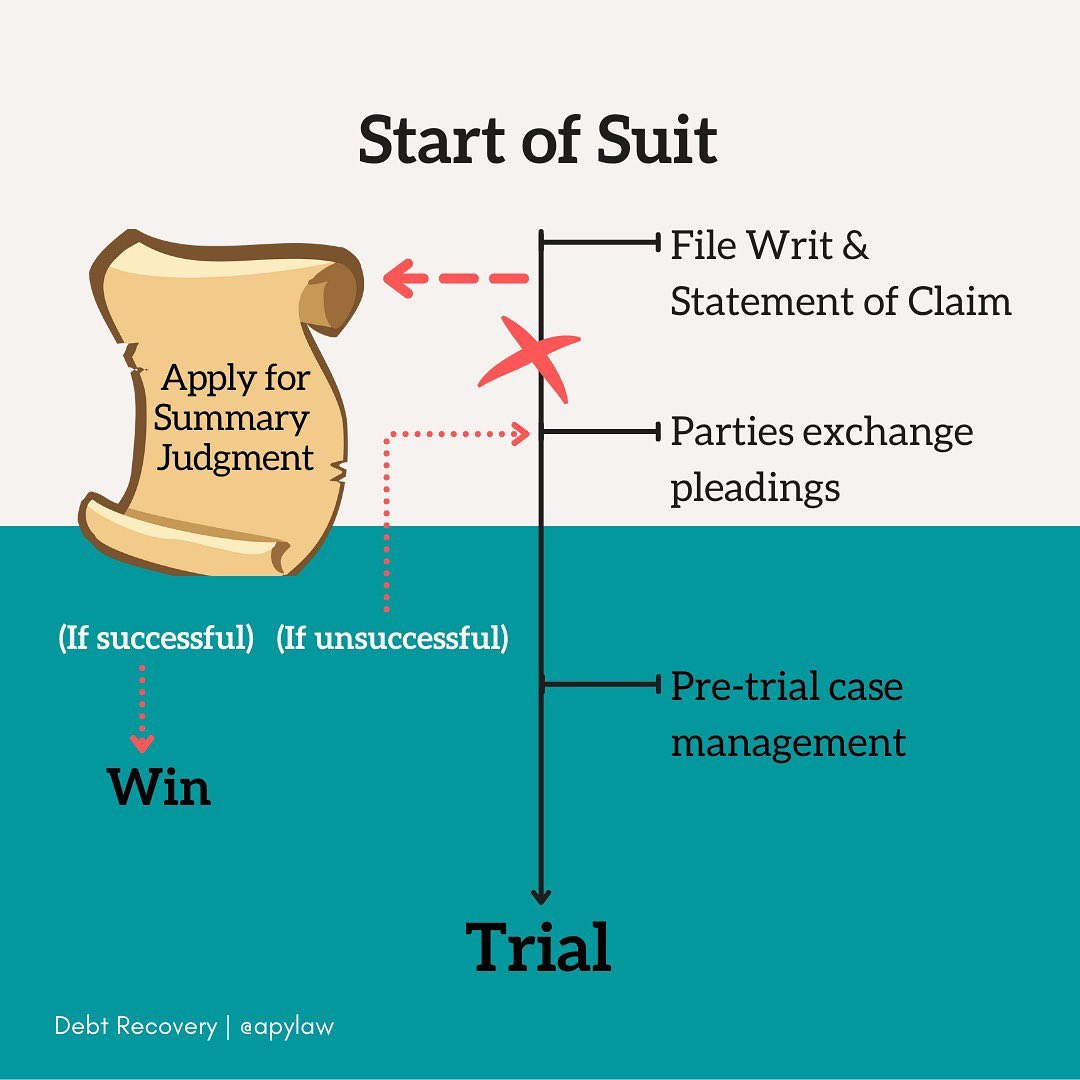

Whilst the default route to claiming money back through the courts involves filing a suit and going to trial, the process can be costly and can drag on for months or even years.

If a creditor believes that it has an overwhelmingly strong case, he/she/it can (at an early stage of the proceeding) apply to the court for a SJ order against the debtor so that the matter can be resolved without having to go to trial.

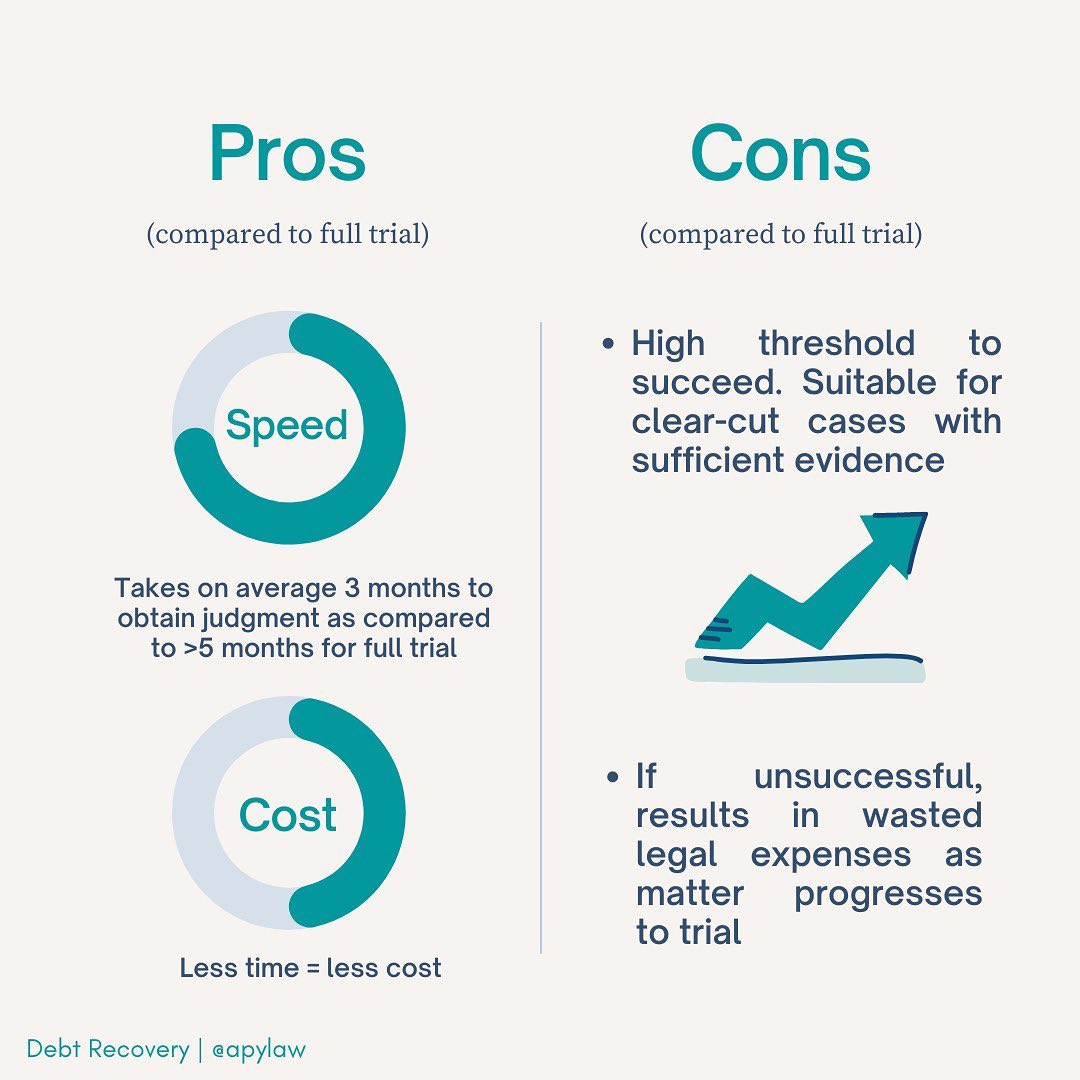

The SJ procedure, as it’s name suggests, can help reduce time and cost in debt recovery litigation, serving as a ‘shortcut’ disposing cases that are straightforward e.g. where there is clear liability on the part of the debtor.

Visual Aid

One of the downsides of the procedure is defeasability. An application for SJ may not succeed if the debtor is able to raise a (valid) reason as to why the case is worthy of further consideration – resulting in wasted legal expenses i.e. additional cost of the “detour” as well as court cost for losing the SJ.

(Note: You may wish to seek legal advice on whether the SJ procedure is suitable for your case specifics considering the legal and financial risks involved.)

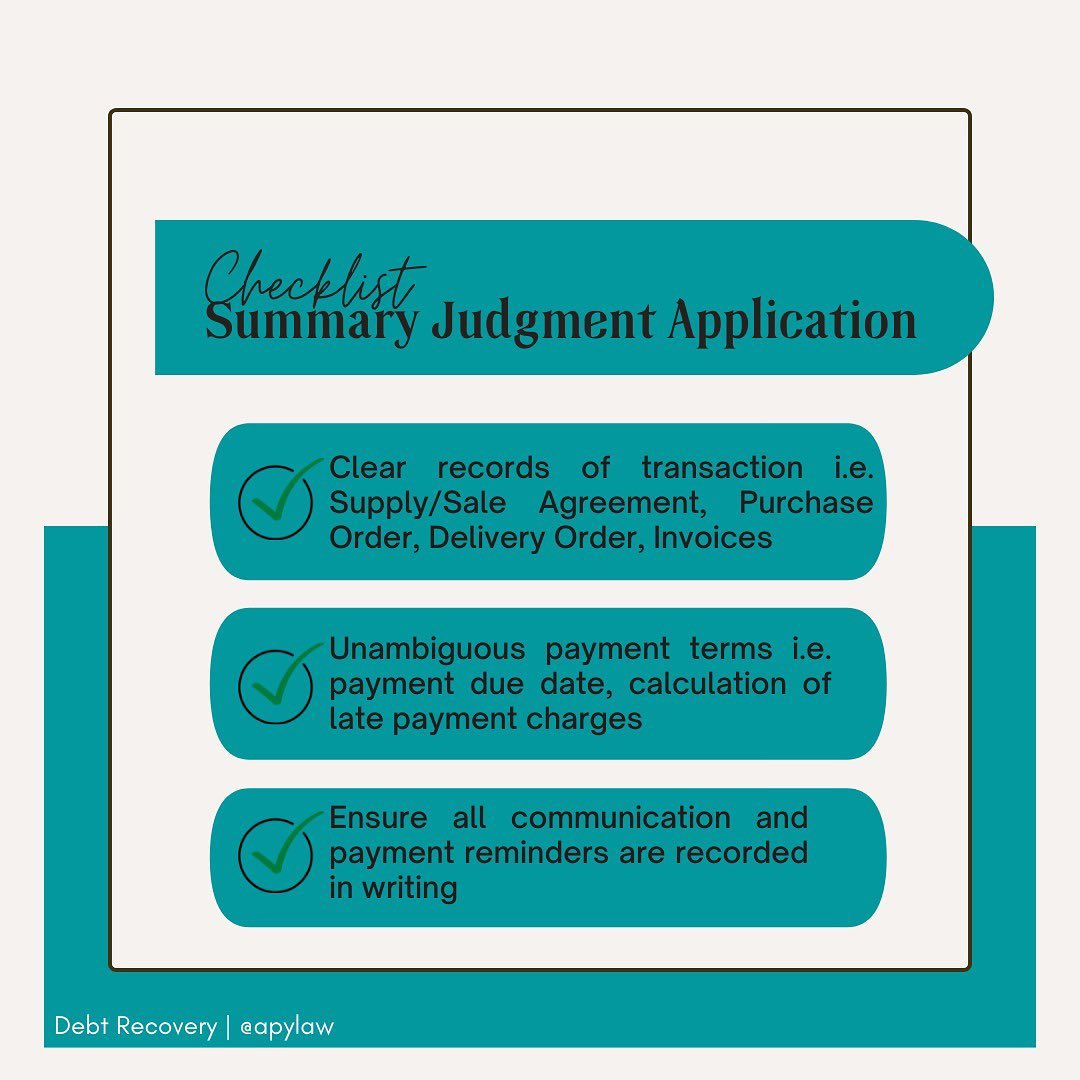

Below, we share a checklist which may assist in ascertaining whether a case is suitable for Summary Judgment. For a typical vendor or supplier transaction, it may often be the case that there is no formal agreement/contract in writing between the parties. In such cases, a good rule of thumb would be to show clear record of transactions and billings i.e. Delivery Orders duly acknowledged, and invoices tally with payment receipts and/or statement of account. Having good evidence will help establish a strong case for Summary Judgment.

This checklist is a mere guideline. Consult a lawyer for legal advice.

(Note: SJ is not applicable to certain claims i.e. claims regarding fraud, libel or slander).

2. Small Claim Procedure

If your claim amount is below RM5,000, individuals (or company representatives) can submit a Small Claim form online or at the Subordinate Court Registry for the case to be heard by a Magistrate.

The procedure is by self-representation only and parties cannot be represented by lawyers. However, parties can and often do get lawyer’s advice on the side. This will obviously reduce the cost and expenditure incurred in recovering debts owed.

A guide on how to file a Small Claim case can be found in the link below: https://judiciary.kehakiman.gov.my/…/Small%20Claim.pdf.

3. Settlement/Writing off bad debts

It goes without saying, there will be times when it is better to write off uncollectable debts than to litigate. Whilst creditors may not be able to claim for the full amount or any amount of the actual debts owing, settling or writing-off bad debts can help businesses refocus on growth.