With the forecast of a new Covid-19 Wave, we revisit some of the common Covid-19 related disputes that arose during the Movement Control Order (MCO).

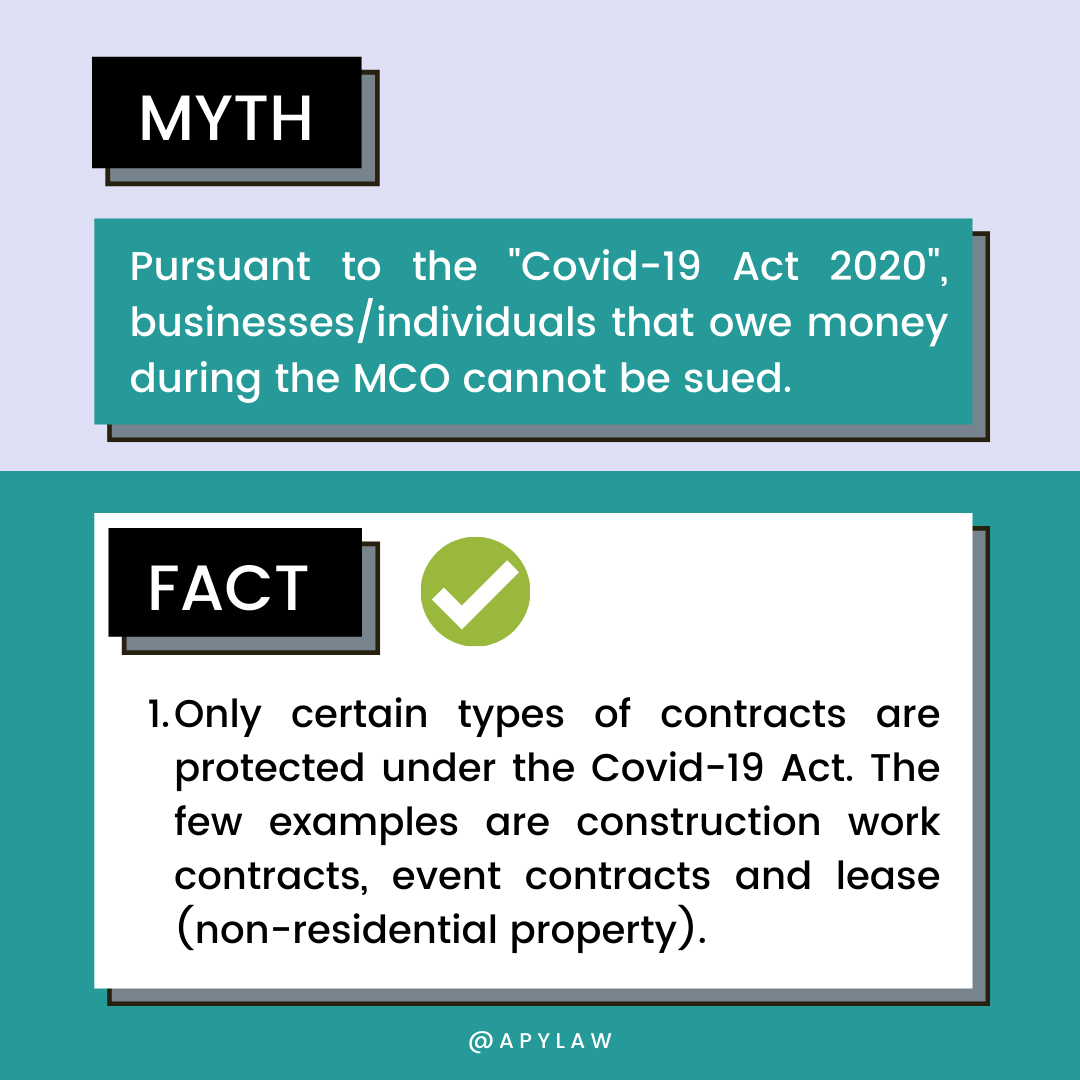

Myth 1: Pursuant to the “Covid-19 Act 2020”, businesses/individuals who owe money during the MCO cannot be sued.

Fact:

Only certain types of contracts are protected under the Covid-19 Act. The few examples are construction work contracts, event contracts and lease or tenancy of non-residential properties.

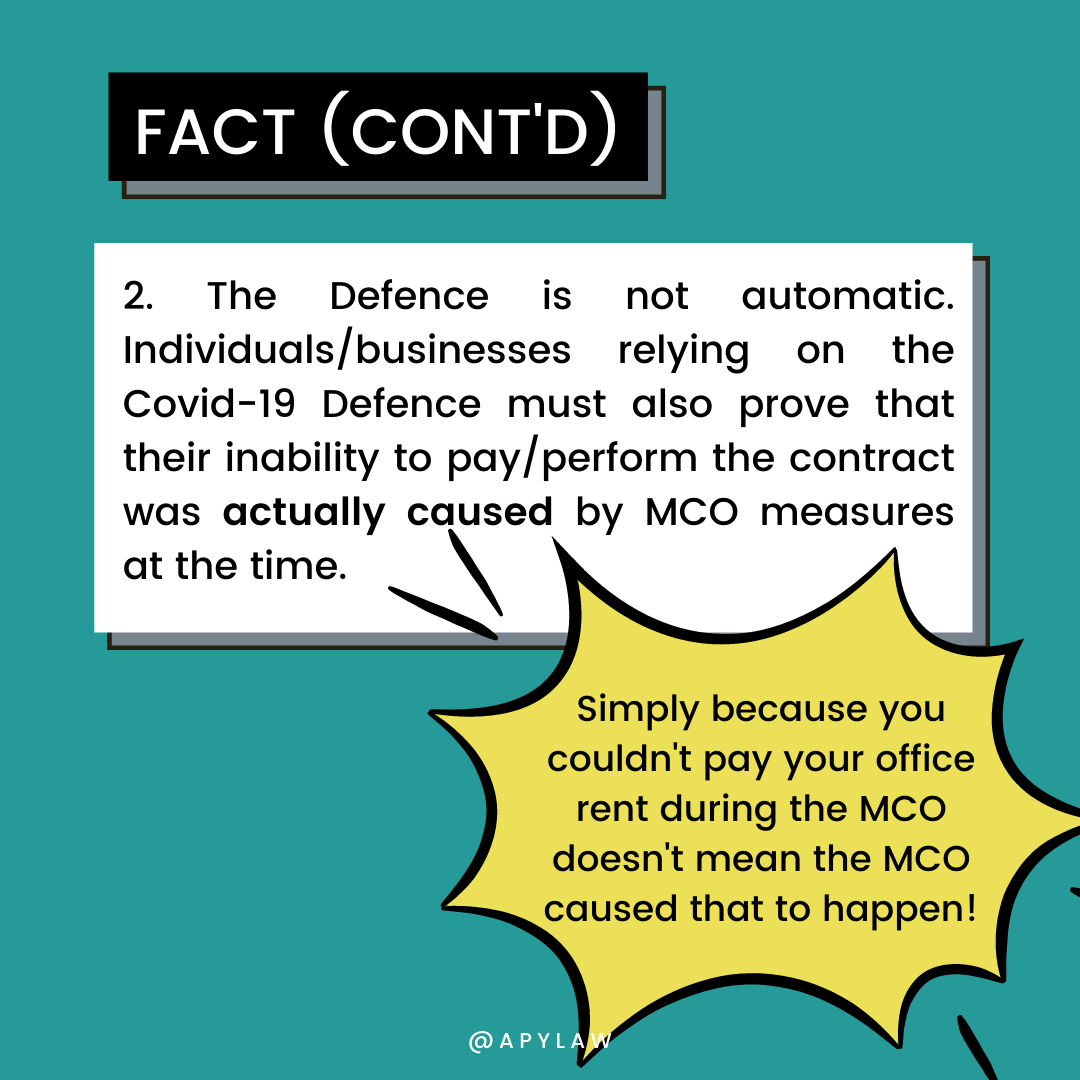

The Covid-19 Defence is not automatic. Businesses/individuals relying on the Defence must also prove that their inability to pay i.e. perform the contract was actually caused by the MCO measures at the time.

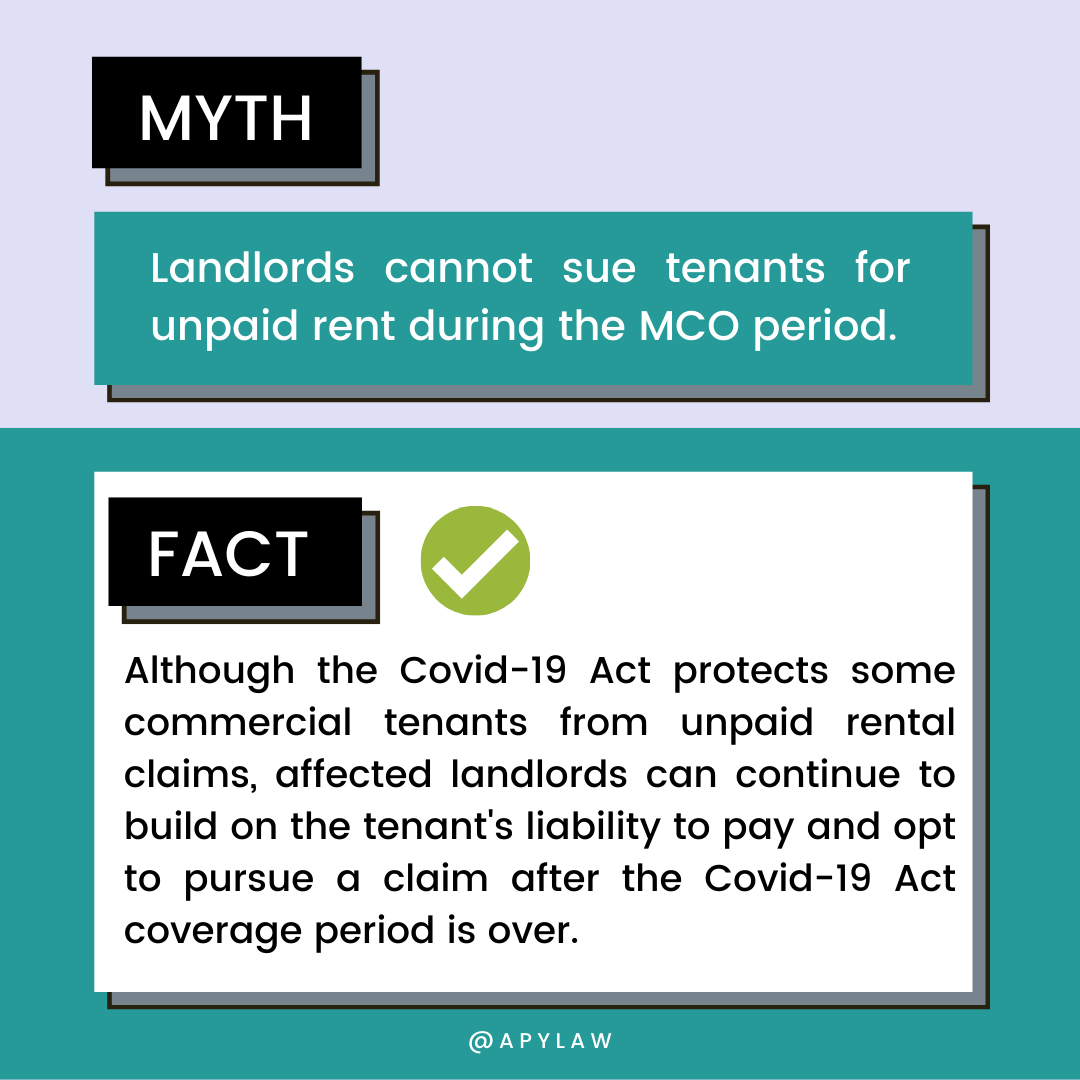

Myth 2: Landlords cannot sue tenants for unpaid rent during the MCO period.

Fact: Although the Covid-19 Act protects commercial tenants from unpaid rental claims (to some extent), affected landlords can continue to build on their tenant’s liability to pay and opt to pursue a claim after the Covid-19 Act coverage period is over.

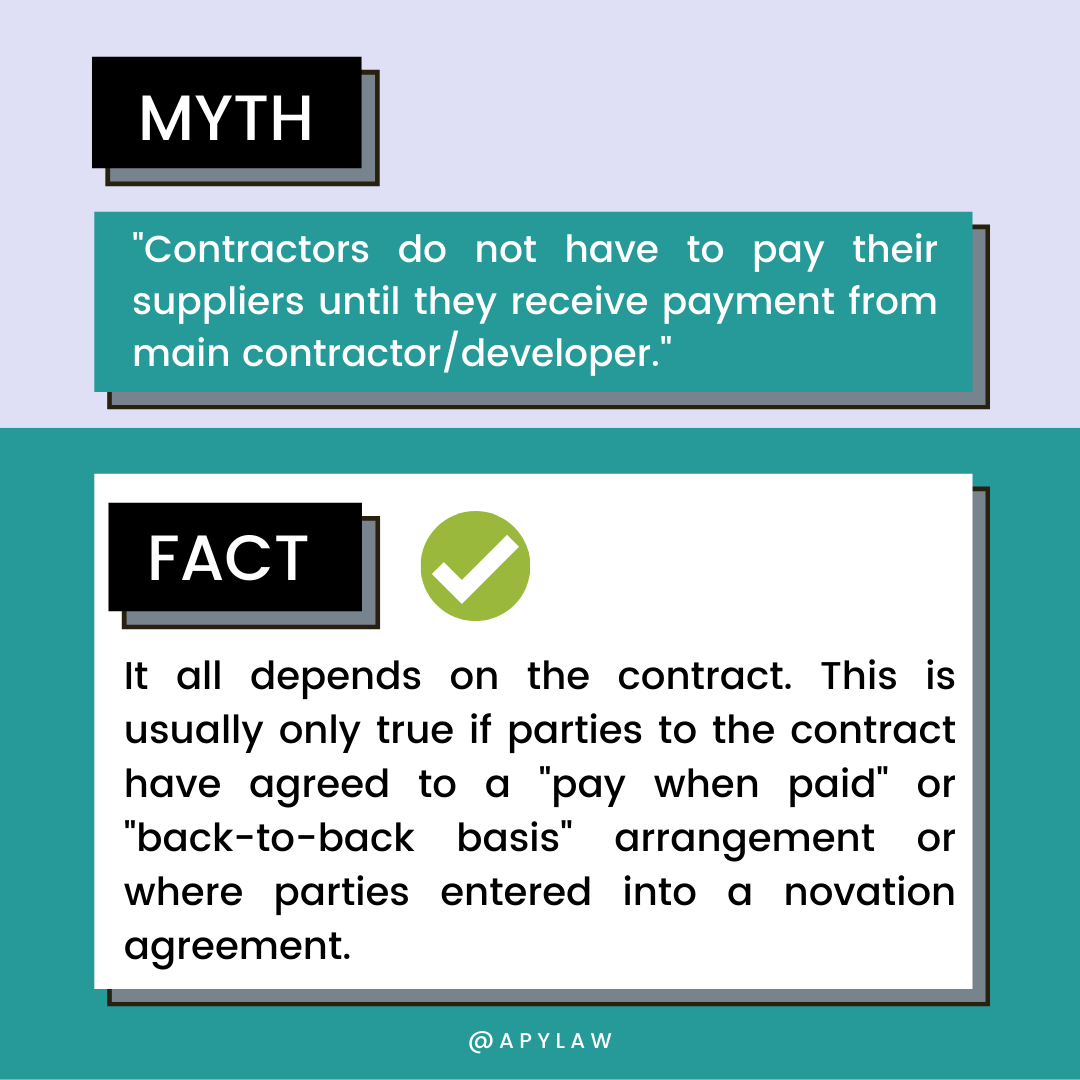

Myth 3: “Contractors do not have to pay their suppliers until they receive payment from i.e. main contractor/developer”.

Fact: It all depends on the contract. This is usually only true if parties to the contract have agreed to a “pay when paid” or “back-to-back basis” arrangement or where parties entered into a novation agreement.

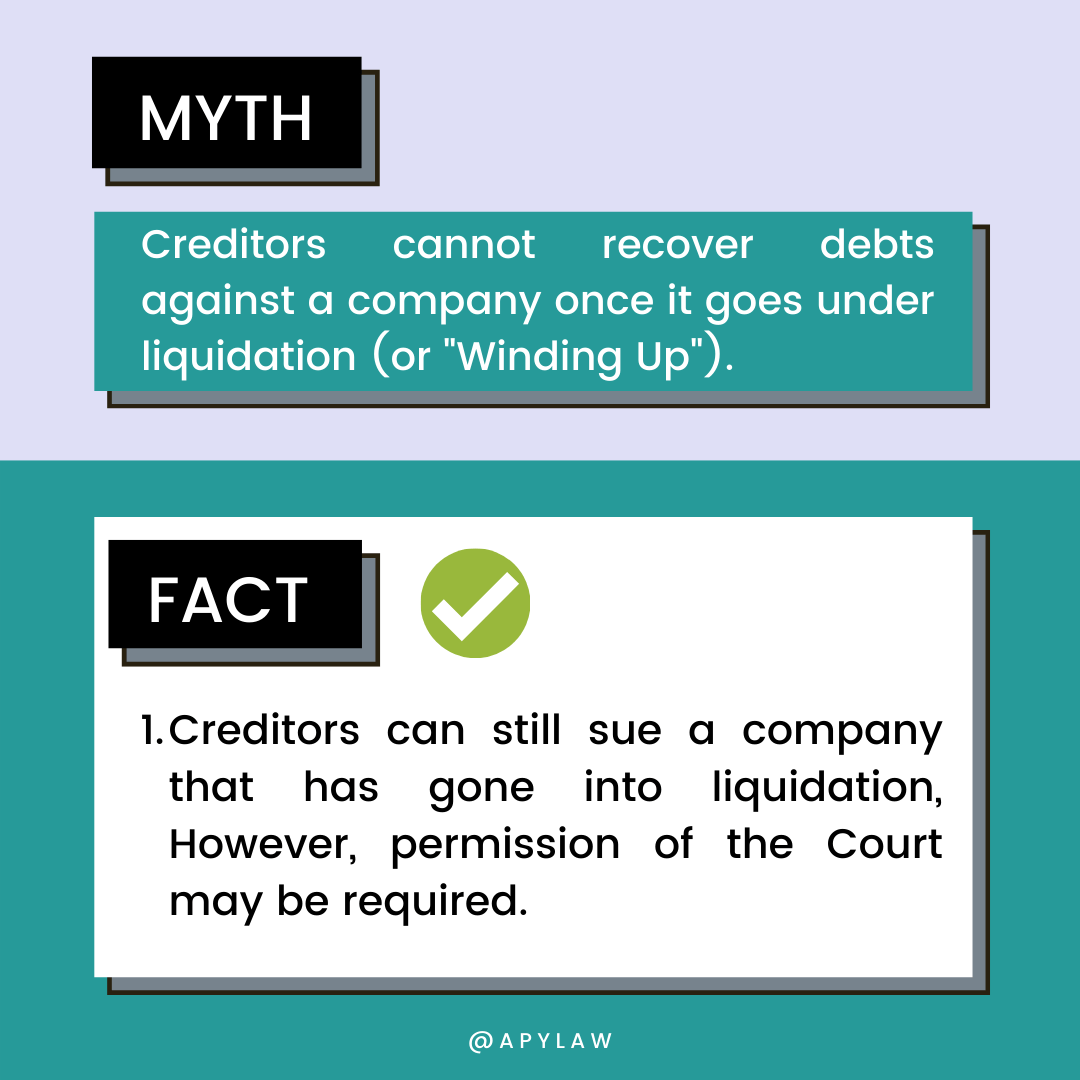

Myth 4: Creditors cannot recover debts against a company once it goes into liquidation (or “Winding Up”).

Fact:

Creditors can still sue a company that has gone into liquidation. However, permission of the Court may be required.

After a company is wound up, creditors have the option to submit a ‘Proof of Debt’ form to the liquidator of the wound up company. In that way, if any of the company’s assets are sold/realized, the creditor will be entitled to dividends payments.

Visual Aid