Subsale properties are properties which are resold from the existing owner. When you buy a subsale property, it means that you are buying from another homeowner rather than directly from the developer.

For those considering to buy a subsale property in Malaysia, below is a step-by-step guide to ease you through the process. The guide below is intended to be merely informational and not to be taken as professional advice. You should consult a lawyer pertaining to the legal documents and latest regulations involved.

STEP 1: INSPECTION AND OFFER TO PURCHASE

When you have found the subsale property you are interested in, do inspect it with the owner/agent to assess the condition of the property.

If you wish to make an offer, a Letter of Offer to Purchase should be signed between you and the seller. At this point, an earnest deposit (usually 3% of the purchase price) is paid to the seller.

STEP 2: FINANCING

If you are not a cash buyer, you may apply for a bank loan or withdraw funds from EPF Account 2 to assist you in financing the property purchase.

It is best to check and compare the financing packages of a few banks in order to help you decide on the best financing package for the purcase.

STEP 3: SALE AND PURCHASE AGREEMENT (‘SPA’)

The SPA will be drafted by solicitors and important clauses include clauses on purchase price, completion period and representations & warranties.

The SPA is usually signed by buyer and seller within 14 days from the date the Letter of Offer to Purchase was signed.

The balance deposit (i.e. 7% of the purchase price) is payable by the buyer upon signing of the SPA.

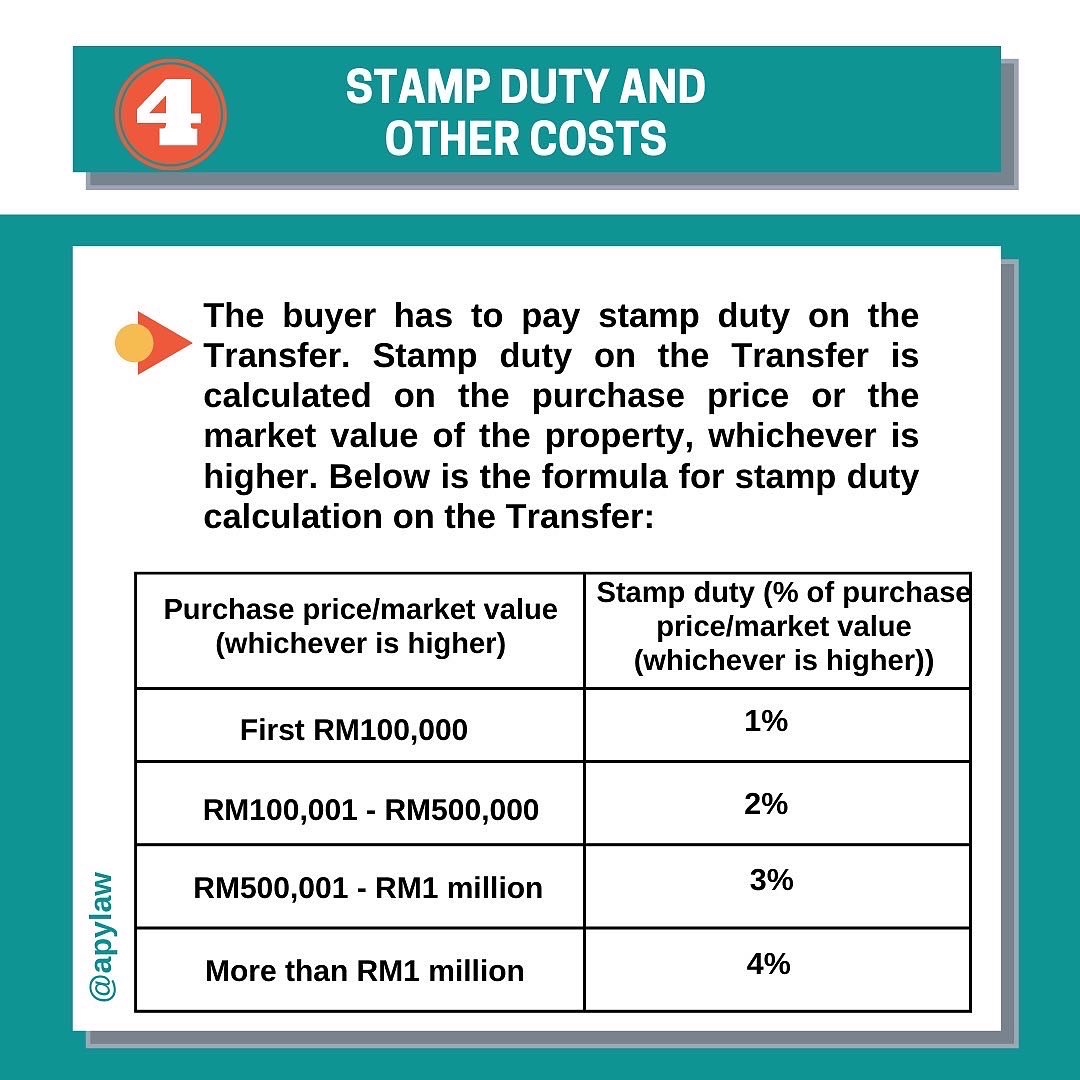

STEP 4: STAMP DUTY AND OTHER COSTS

The buyer has to pay stamp duty on the Transfer. Stamp duty on the Transfer is calculated on the purchase price or the market value of the property, whichever is higher. (You may find the formula for stamp duty calculation on the Transfer in the 4th slide at the bottom of this page).

The buyer must also bear the stamp duty on the loan documentation which is a flat rate of 0.5% of the loan amount.

Other costs the buyer will have to pay include legal fees for preparation of the SPA and loan documentation and the registration fees for the transfer and charge at the land office.

STEP 5: TIME FRAME FOR COMPLETION

Generally, completion of the sale and purchase of the property takes approximately 3 months.

However, if the property is subject to restrictions in interest (i.e. the property cannot be transferred without the state authority’s consent to transfer), the completion period may be longer as the state authority’s consent needs to be applied for and obtained.

STEP 6: NOTIFICATIONS TO LOCAL AUTHORITIES & UTILITY SERVICE PROVIDERS

Upon completion of the sale and purchase, buyer should notify the relevant local authorities and utility service providers of the change in ownership to ensure that future bills/notifications will be sent to the buyer as the new owner.

Visual Aid